whats stone county ms income limit to qualify for fha down payment assistance

USDA eligibility for 2022

USDA eligibility is based on a combination of household size and geography, in addition to the typical mortgage approval standards such as income and credit score verification.

USDA eligibility for a one-4 member household requires annual household income to not exceed $91,900 in most areas of the state, and almanac household income for a v-viii member household to non exceed $121,300 for almost areas.

Whether y'all want to purchase a home or refinance via USDA, this plan is ultra-accessible and affordable.

In this article (Skip to...)

- The USDA program

- USDA eligibility

- Current income limits

- Property requirements

- USDA mortgage insurance

The USDA home loan program

The USDA loan program is one of the best mortgage loans bachelor for qualifying borrowers.

In that location'southward no down payment required, and mortgage insurance fees are typically lower than for conventional or FHA loans. USDA interest rates tend to be below-market, also.

To authorize for 100% financing, abode buyers and refinancing homeowners must meet standards set by the U.S. Department of Agronomics, which insures these loans.

Luckily, USDA guidelines are more lenient than many other loan types.

USDA eligibility requirements

Basic USDA loan requirements include:

- Minimum credit score — 640 with most lenders

- Clean credit history — No late payments or contempo bankruptcy or foreclosure

- Income requirements — Income limits vary by area; oftentimes $91,900 for a one-4 person household

- Employment — Borrowers need a steady income and employment history. Cocky-employment is eligible

- Geographic requirements — You lot must own a home in an eligible area

- Property requirements — Must be a single-family home you'll use as your principal residence

- Loan type — But a 30-year, fixed-rate mortgage is allowed

In addition, most USDA lenders want borrowers to have a debt-to-income ratio (DTI) below 41 percent.

That means your monthly debt payments (including things similar credit cards, auto loans, and your future mortgage payment) shouldn't take upward more than 41% of your gross monthly income.

This dominion is non fix in rock, though.

USDA is flexible well-nigh its loan requirements. And lenders tin sometimes approve applications that are weaker in ane expanse (like credit score or DTI) just stronger in another (like income or down payment).

USDA's goal is to aid low- and moderate-income buyers become homeowners. So if y'all come across the basic criteria — or you're close — check your eligibility with a lender.

USDA income limits

USDA's income limit is set at 115% of your area's median income (AMI). That means your household income tin can't exist more than 15% above the median income where you alive.

The actual dollar amount varies past location and household size. For instance, USDA allows a higher income for households with five-8 members than for households with 1-four members.

And, USDA income limits are higher in areas where workers typically earn more than.

Here's just a sample to bear witness you how USDA income eligibility can vary by location:

| Area | 2021 Income Limit for ane-4 Person Household | 2021 Income Limit for five-8 Person Household |

| Adams County, Nebraska | $91,900 | $121,300 |

| Duluth, Minnesota | $96,300 | $127,100 |

| Olympia-Tumwater, Washington | $103,700 | $136,900 |

| Napa, California | $135,250 | $178,550 |

You lot tin can bank check electric current USDA income limits for your county here.

USDA property eligibility

Officially called the 'rural evolution loan," USDA'south mortgage plan is intended to promote homeownership in underserved parts of the state.

Because of this, the The states Department of Agriculture will merely guarantee loans in eligible "rural" areas.

Only don't be deterred. USDA's definition of 'rural' is looser than you might wait at start.

You don't have to buy a lot of country or piece of work in agronomics to be USDA eligible. Y'all but need to alive in an area that'south not densely populated.

Officially, USDA defines a rural area as one that has a population under 35,000 or is "rural in character" (meaning there are some special circumstances). And that covers the vast majority of the U.Due south. landmass.

And so before yous write off a USDA loan, check your area'southward status. Yous can notice out if a belongings is eligible for a USDA loan on USDA's website. Most areas outside of major cities qualify.

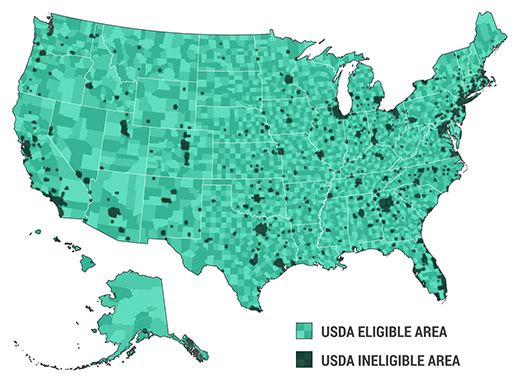

USDA eligibility map

Source: USDAloans.com based on Housing Assist Council data

USDA mortgage insurance requirements

The USDA single-family housing guaranteed program is partially funded by borrowers who utilize USDA loans.

Via mortgage insurance premiums charged to homeowners, the regime is able to keep the USDA rural development program affordable.

USDA final changed its mortgage insurance rates in October 2016. Those rates remain in effect today.

Today's USDA mortgage insurance rates are:

- i.00% upfront fee, based on the loan size (can be rolled into the loan residuum)

- 0.35% annual fee, based on the remaining master balance

As a real-life case of how USDA mortgage insurance works, let's say that a dwelling house buyer in Cary, North Carolina is borrowing $200,000 to purchase a home with no money down.

The buyer's mortgage insurance costs include a $2,000 upfront mortgage insurance premium, plus a monthly $58.33 payment for mortgage insurance.

Note that the USDA upfront mortgage insurance is non required to be paid every bit cash. It can be added to your loan balance to reduce your funds required at closing.

Check your USDA eligibility

USDA-guaranteed loans can exist used for home buying and to refinance real manor you already own (as long as information technology'southward in an eligible area).

For those who qualify, this is oftentimes ane of the best loan options available.

USDA loans are great for kickoff-time dwelling house buyers in item, as you don't need whatever coin saved upward for the down payment. But remember — you'll still take to pay for closing costs.

Information technology could exist easier than you think to qualify for a domicile loan via the USDA program. Bank check your eligibility with a USDA-approved lender today.

The information contained on The Mortgage Reports website is for advisory purposes simply and is not an advertizement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Total Beaker, its officers, parent, or affiliates.

Source: https://themortgagereports.com/16242/usda-loan-income-limits-eligibility

0 Response to "whats stone county ms income limit to qualify for fha down payment assistance"

Post a Comment